The Republican 2025 Budget: Who Wins, Who Loses, and What It Means for You

A plain-English breakdown of the GOP’s budget plan—where the money is going, what’s being cut, and how it impacts everyday Americans.

On February 25, 2025, House Republicans pushed through their budget plan with a razor-thin 217-215 vote. This blueprint lays out their priorities for government spending, tax policy, and the national debt over the next decade.

The key points? Trillions in tax cuts, deep spending reductions, and a hefty increase to the debt ceiling.

This post is an in-depth analysis of the budget, and it’s impact on everyday Americans.

This is Too Important to Paywall

Normally, an in-depth post like this would be for my paid subscribers only. But this is too important to keep behind a paywall. Every American deserves to understand what the Republicans are trying to do with their latest budget plan—what’s in, what’s out, and what it really means for all of us.

Hold onto your butts! This is going to be a long one.

Let’s break it down in plain English.

The Big Takeaways

$4.5 trillion in tax cuts – Primarily benefiting the wealthiest Americans and corporations.

$2 trillion in spending cuts – Medicaid, food assistance programs, and other social safety nets take the biggest hits.

More money for defense and border security – Military spending is going up, and the budget prioritizes strict immigration enforcement.

A $4 trillion debt ceiling increase – Allowing the government to keep borrowing to cover expenses, despite claiming to want to reduce the national debt.

Social Security left untouched—for now – But Medicaid? Not so lucky.

Let’s Dive Into the Details

I’ll break down each section of the budget and provide tables and charts. Each part also has key takeaways, so if you want the “tl;dr”, skip to those.

Section 1001: Recommended Levels and Amounts

Section 1001 of the Republican 2025 Budget lays out the financial roadmap for the next decade, specifying how much the government expects to collect (revenues), how much it plans to spend (budget authority and outlays), and the resulting deficit or surplus. Essentially, this section tells us where the money is coming from and where it’s going.

In simple terms:

Federal revenues are the government’s income, mostly from taxes.

New budget authority is how much Congress allows agencies to commit to spending.

Budget outlays are the actual payments the government makes.

Deficits occur when spending exceeds revenue, adding to the national debt.

Debt subject to limit is the total amount the government is legally allowed to borrow.

Debt held by the public is the portion of the national debt that’s borrowed from outside investors like individuals, banks, and foreign governments.

Now, let’s look at the numbers.

Table 1: Federal Revenues (Projected)

This table shows how much money the federal government expects to collect in the next 10 years.

Key takeaway: Even though revenues are projected to rise, the plan includes a $450 billion reduction every year—likely from tax cuts.

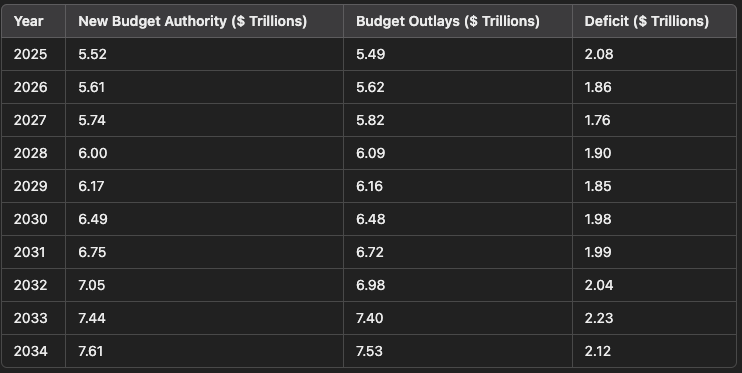

Table 2: Spending and Deficit Trends

This table shows the projected government spending and the resulting deficit.

Key takeaway: The government will continue running a deficit, adding trillions to the national debt over the next decade.

Chart 1: Debt Growth Over Time

Here’s a chart showing the projected increase in U.S. federal debt over the next decade. The debt subject to limit (total government debt) and debt held by the public (money borrowed from investors) are both rising significantly, despite the budget’s claim of fiscal responsibility.

Key takeaways: By 2034, the U.S. government is expected to be carrying over $55.57 trillion in debt, with more than $48.6 trillion of that held by the public.

This is just the beginning of the deep dive into the Republican 2025 budget. Now let’s look at where this money is actually going.

Section 1002: Major Functional Categories

Section 1002 of the Republican 2025 Budget outlines how the federal government plans to allocate its spending across different areas, known as major functional categories. These categories cover everything from national defense and healthcare to education and infrastructure.

In simple terms, this section tells us:

Which programs and services are getting more money

Which areas are facing cuts or stagnation

How government priorities are shifting over the next decade

This is where we see what the government actually values—not just in words, but in dollars. Now, let’s break it down with some tables and charts to make it easy to see where your tax dollars are going.

Table 3: Federal Spending by Major Category (2025-2034)

This table provides a high-level view of how much money is allocated to different areas of the government.

Chart 2: Federal Spending by Category (2025 vs. 2034)

This bar chart compares federal spending in different categories for 2025 vs. 2034.

Key takeaways:

Defense spending is rising significantly, from $888 billion in 2025 to $1.1 trillion by 2034.

Healthcare and Medicare see an increase, from $945 billion to $1.3 trillion.

Veterans benefits and Social Security also grow, reflecting increased demand.

Infrastructure and education see only modest increases, suggesting they are not a top priority.

General government expenses triple, though they remain a small part of the budget.

Now that we know where the money is going, let’s look at the cuts.

Section 2001: Reconciliation in the House of Representatives

Section 2001 of the Republican 2025 Budget is all about budget reconciliation, a process that allows Congress to fast-track changes to taxes, spending, and deficits. This section directs specific committees to propose laws that either reduce spending or adjust revenues to align with the budget’s goals.

In short, this section tells us:

Which committees are responsible for making budget cuts

How much each committee must cut (or increase) in spending

How these changes contribute to the overall deficit reduction plan

This is where we see who’s getting cut and by how much. Let’s break it down with tables to clearly show which programs are on the chopping block.

Table 4: Budget Cuts and Increases by Committee (2025-2034)

Key Takeaways from the Budget Reconciliation Plan:

Massive $4.5 trillion tax cut via the Ways & Means Committee → This suggests major tax reductions, likely favoring corporations and high-income individuals.

$880 billion cut from Energy & Commerce → This committee oversees Medicaid, Medicare, and healthcare programs, meaning healthcare spending is a prime target.

$330 billion cut from Education & Workforce → Expect reduced funding for public schools, student aid, and job training programs.

$230 billion cut from Agriculture → Likely reductions in farm subsidies and food assistance programs like SNAP (food stamps).

Defense spending increase of $100 billion → Military and national security programs get a boost, even as domestic spending is slashed.

Judiciary and Homeland Security see increases → Likely for law enforcement, border security, and immigration enforcement.

Now, let’s visualize where the biggest cuts and increases are happening with a bar chart.

Chart 3: Budget Cuts and Increases by Committee (2025-2034)

Key takeaways:

The largest increase is a $4.5 trillion boost to the Ways & Means Committee, indicating massive tax cuts.

Healthcare, education, and food assistance programs take the biggest hits, with major reductions in the Energy & Commerce, Education & Workforce, and Agriculture Committees.

Defense, law enforcement, and border security get more funding, while public programs face cuts.

Section 2001 makes it clear: this budget is cutting social programs while giving huge tax breaks and boosting defense and border security.

Now that we’ve covered the major spending and tax changes, let’s break down the fine print—where many of the biggest risks and hidden tricks of this budget are buried.

Title III: The "Reserve Fund" (Section 3001-3002)

What It Does

The reserve fund is like a budget safety valve. It allows Congress to adjust spending if certain conditions are met. If lawmakers pass legislation that meets specific deficit-reduction targets, they can shift money around to accommodate those changes.

Biggest Risk / Hidden Trick

This is a backdoor for surprise cuts.

If Congress fails to cut $2 trillion from mandatory spending, then automatic reductions kick in elsewhere. That means cuts could suddenly hit Medicare, Social Security, or other programs—even if they weren’t directly targeted in the original budget.

The rules for meeting the deficit target are vague, meaning the party in power has flexibility to define what counts as "deficit reduction."

Title IV: Policy Statements (How Republicans Justify Their Cuts)

This is where the real ideology behind the budget comes into play. These sections explain the reasoning behind why spending is being slashed in some areas and increased in others.

Economic Growth (Section 4001)

What It Says: The budget claims that cutting taxes, deregulating businesses, and shrinking the size of government will boost economic growth and reduce the deficit.

Biggest Risk / Hidden Trick

The idea that tax cuts pay for themselves has been repeatedly debunked (see: Bush tax cuts, Trump tax cuts). Cutting taxes usually increases the deficit, not lowers it.

This plan assumes GDP growth will magically offset revenue losses, but doesn’t back that up with data.

Reality Check: Historical data shows that trickle-down economics doesn't work—corporate tax cuts don’t necessarily lead to job growth or higher wages, but they do lead to ballooning deficits.

Mandatory Spending Reductions (Section 4002)

What Is Mandatory Spending?

Mandatory spending refers to government expenses that are required by law. Unlike discretionary spending, which Congress debates and approves annually, mandatory spending happens automatically based on pre-existing laws.

It primarily funds programs like Social Security, Medicare, Medicaid, and federal assistance programs (e.g., food stamps/SNAP, unemployment benefits, and veterans’ benefits).

Since mandatory spending is locked in by law, it can only be changed if Congress amends or reforms the laws governing these programs.

How A Republican Budget Can Require Reductions In Mandatory Spending

Since mandatory spending is set by law, Congress can’t simply cut funding for Social Security, Medicare, Medicaid, or other entitlement programs the way it does with discretionary spending (like defense, education, or infrastructure). Instead, Republicans use specific legislative maneuvers to force reductions in these programs. Here’s how they do it:

Reconciliation Process: A special budget process that allows spending cuts (or tax changes) to pass with a simple majority in the Senate—no filibuster allowed.

Changing Eligibility Requirements: Instead of cutting overall funding, Congress raises the age to qualify, adds work requirements, or caps income limits—effectively reducing the number of people who receive benefits.

Block Grants & Spending Caps: Instead of guaranteeing funding based on need, Congress caps the total amount available, shifting costs to states or individuals.

Automatic "Trigger Cuts": A budget rule that says, “If we don’t hit a deficit target, automatic cuts kick in.”

Privatization or Restructuring: Instead of cutting benefits directly, Republicans may propose replacing public benefits with private alternatives that cost more or shift risk to individuals.

Given that…

What It Says: The government must cut at least $2 trillion from programs like Medicaid, food assistance (SNAP), and disability benefits.

Biggest Risk / Hidden Trick

The budget doesn’t specify how these cuts will happen, just that they must happen. That means lawmakers can later target different groups quietly, making it harder to challenge specific cuts.

"Mandatory spending" includes Medicare, Medicaid, Social Security, and VA benefits, meaning those are the biggest areas at risk.

Reality Check: The lack of details is intentional. By not listing specific cuts, lawmakers avoid immediate backlash—until the cuts start happening.

Government Deregulation (Section 4003)

What It Says: Cutting regulations will help businesses grow by reducing red tape in industries like energy, healthcare, and finance.

Biggest Risk / Hidden Trick

Deregulation often benefits large corporations, not everyday people.

Cuts to environmental protections could mean more pollution, relaxed safety standards, and higher risks for public health.

Rolling back financial regulations could make it easier for big banks to take risks—potentially leading to another financial crisis.

Reality Check: Past deregulation efforts have often led to major problems—the 2008 financial crisis happened after deregulating banks, and reducing environmental protections has led to increased pollution and public health crises.

Title V: Other Matters (The Rule-Changing Sections)

This section contains technical budget rules that dictate how the numbers are enforced and adjusted over time. But hidden in the language are ways Congress can quietly shift money and change the rules to their advantage.

Enforcement & Budget Rule Adjustments (Sections 5001-5003)

What It Says: Sets new budget rules that control how spending caps and tax policies are enforced.

Biggest Risk / Hidden Trick

These rules can be changed later to raise or lower spending caps—meaning the numbers in this budget aren’t set in stone.

Loopholes allow backdoor tax breaks to be added later without triggering deficit concerns.

Reality Check: While these enforcement rules sound strict, they can be rewritten whenever it's politically convenient. That means Republicans could later decide to cut even more from social programs while keeping tax breaks intact.

Adjustments & Rulemaking (Sections 5004-5006)

What It Says: Allows the budget to be adjusted if economic conditions change—basically, a way to tweak numbers without having to vote on an entirely new budget.

Biggest Risk / Hidden Trick

This lets lawmakers quietly move money around without public scrutiny.

"Baseline adjustments" can hide the real costs of tax cuts by shifting deficits into future years.

Reality Check:

Think of this as a financial "edit button"—lawmakers can rewrite key parts of the budget later without having to publicly defend their decisions.

Final Thoughts: The Big Picture

After analyzing the full Republican 2025 Budget, here’s the overall theme:

Big tax cuts for corporations & the wealthy—paid for by cutting social programs.

Healthcare, education, and food assistance are taking the biggest hits.

Defense, border security, and law enforcement get big funding boosts.

Deregulation benefits businesses but poses risks for everyday people.

Hidden rule changes allow for surprise cuts and shifts in spending.

What This Means for You

This budget paints a stark picture of who wins and who loses under Republican leadership. This is not just about numbers—this budget reflects Republican priorities and their vision for how the government should operate.

If this budget is passed as is, expect:

Lower corporate taxes (good for businesses, but likely to increase deficits).

Cuts to healthcare & social programs (Medicaid, SNAP, education aid could all shrink).

Increased military & border spending (potentially at the expense of domestic programs).

Sneaky rule changes allowing lawmakers to quietly shift money around later.

Healthcare will be more expensive, student aid may shrink, and food assistance could be cut—all while the deficit continues to grow.

This is not just about balancing a budget; it's about reshaping the role of government. If this plan succeeds, it will fundamentally alter the social safety net, prioritizing tax cuts for the wealthy over support for struggling families.

What Can You Do?

This is the time to pay attention.

Call your representatives. Share this information. Make your voice heard.

Budgets aren’t just policy documents—they impact real lives. And this one? This one could change the country in ways that will be felt for decades to come.

Stay tuned for updates, and as always, let’s talk about it.